Juntos Seguros and Financial Stability for Immigrant Families

Starting life in a new country often comes with financial uncertainty. Many immigrant families work hard, save carefully, and still feel unprotected when something unexpected happens.

Medical bills, car accidents, or sudden job loss can quickly create stress. This article helps you understand how services like Juntos Seguros can support financial stability and peace of mind, especially if you are new to insurance or unsure where to start.

Why financial stability is a major challenge for immigrant families

When you move to a new country, the systems are unfamiliar. Rules, documents, and costs can feel confusing or overwhelming.

Limited access to traditional financial services

Many families do not have a long credit history. Some may not have all the documents that banks or insurers usually ask for.

This can make it harder to open accounts or get coverage.

Income uncertainty and irregular work

Immigrant families often work in hourly, seasonal, or contract jobs. Income can change from month to month.

When income is not predictable, planning for emergencies becomes harder.

Lack of clear information in your language

Important financial information is often only in English. If it is not your first language, it is easy to miss details or misunderstand terms.

This leads many families to avoid insurance altogether, even when they need it.

What is Juntos Seguros and how does it fit into family protection?

Juntos Seguros is designed to make insurance simpler and more accessible. It focuses on helping families protect what matters most without complicated processes.

See also Complete Guide to Juntos Seguros: Immigration, ICE App, Website Issues & Financial Safety

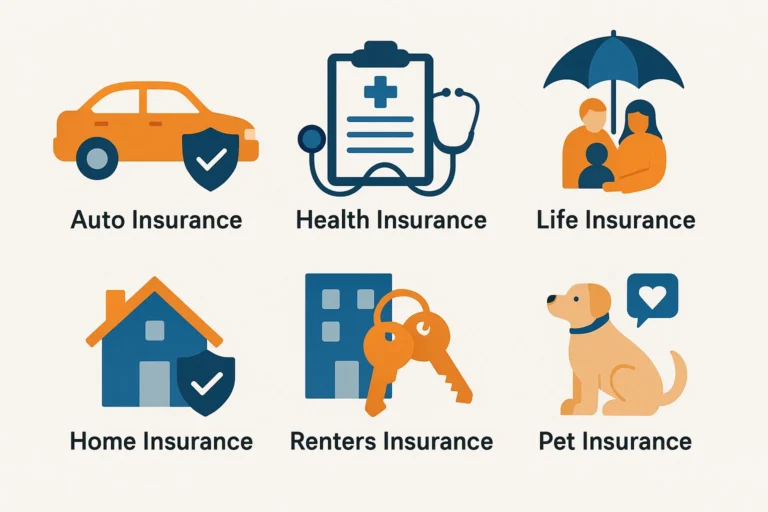

A simpler approach to insurance

Many traditional insurance systems feel complex. Juntos Seguros aims to remove barriers by using clear steps and user-friendly tools.

This makes it easier for families to understand what they are buying and why.

Designed with immigrant needs in mind

Immigrant families often need flexibility. They may need coverage that fits changing work, housing, or family situations.

Juntos Seguros is structured to support these realities rather than ignore them.

How Juntos Seguros supports financial stability

Financial stability is not just about saving money. It is about reducing risk and being prepared for the unexpected.

Protection from sudden expenses

A single accident or illness can cost thousands. Insurance helps absorb those costs so families do not have to empty their savings.

This keeps finances steady during difficult times.

Encouraging long-term planning

When families feel protected, they plan more confidently. They can focus on education, home goals, or business ideas.

Security allows growth.

Reducing emotional and financial stress

Money problems affect mental health. Knowing that you have coverage reduces worry and helps families sleep better at night.

This is an often overlooked but very real benefit.

Common misconceptions about insurance in immigrant communities

Many families avoid insurance because of myths or misunderstandings.

“Insurance is only for wealthy people”

This is not true. Insurance exists to protect people who cannot afford large losses.

It is a safety tool, not a luxury.

“It is too complicated to apply”

Modern platforms, including Juntos Seguros, are built to be simple. You do not need to be an expert to get started.

Clear guidance and step-by-step processes make a big difference.

“I will never need it”

No one plans accidents or illnesses. Insurance is there for events you cannot predict.

Having it does not mean you expect problems. It means you are prepared.

How families can use Juntos Seguros more effectively

Understanding the tool is only the first step. Using it wisely is what builds real stability.

Choose coverage based on real risks

Think about your daily life. Do you drive often? Do you have children? Is your job physically demanding?

Pick protection that matches your actual risks, not what sounds good.

Review your coverage regularly

Life changes. New jobs, new homes, and new family members all affect your needs.

Check your coverage once or twice a year to make sure it still fits.

Ask questions and seek clarity

Never feel embarrassed to ask. Understanding your policy helps you use it properly when needed.

Clear understanding prevents disappointment later.

The role of trust and community in financial decisions

Immigrant families often rely on community advice. Friends and relatives share experiences and recommendations.

This is powerful, but it should be balanced with accurate information.

Why trusted platforms matter

When a service is built with transparency and fairness, it builds confidence. Families are more likely to engage when they feel respected and understood.

This is where platforms like Juntos Seguros can play a positive role.

Learning from shared experiences

Hearing how others benefited from insurance can change perspectives. Real stories help people see value beyond theory.

Community knowledge combined with reliable services creates strong support.

FAQs

Is Juntos Seguros only for immigrants?

No. While it is very helpful for immigrant families, anyone looking for simple and accessible insurance can use it.

Do I need perfect documents to get started?

Not always. Many platforms are designed to be flexible and guide you through what is needed step by step.

Can insurance really improve financial stability?

Yes. It protects your savings and income from sudden losses, which is a key part of staying financially stable.

Final thoughts

Financial stability is not built overnight. It grows through smart decisions, protection, and planning.

For immigrant families, having the right support makes a huge difference. Services like Juntos Seguros help reduce risk, increase confidence, and support long-term security.

When families feel protected, they can focus on building a better future. And that is what real stability is all about.