Juntos Seguros: Why Personalized Insurance Plans Are the Future of Coverage

Introduction

The world of insurance is rapidly evolving to meet the unique needs of individuals and families. Gone are the days of one-size-fits-all policies. Juntos Seguros is at the forefront of this transformation by offering personalized insurance plans that adapt to your lifestyle, needs, and financial goals. This article delves into why personalized coverage is more than just a trend—it’s the future of the insurance industry.

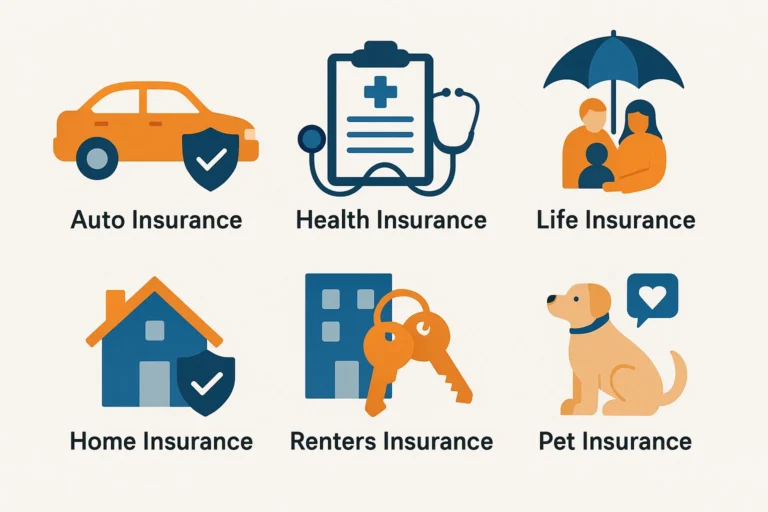

1. What Are Personalized Insurance Plans?

Personalized insurance plans are tailored policies that adjust to your specific circumstances rather than relying on generic templates. With Juntos Seguros, customers can:

- Select only the coverage they need

- Adjust their policies over time as life changes

- Pay premiums based on actual risk and behavior

This approach empowers users to design a plan that fits their budget and lifestyle without unnecessary add-ons.

2. One Size Doesn’t Fit All: The Need for Customization

Every individual or family has different priorities—whether it’s health, home, auto, or life insurance. Juntos Seguros recognizes this by:

- Offering modular policy options

- Allowing add-ons for specific needs like travel, dental, or critical illness

- Providing plans for single individuals, couples, or families

This flexibility helps people avoid overpaying for coverage they don’t need while ensuring they’re protected where it matters most.

3. Smarter Pricing with Usage-Based Premiums

Juntos Seguros is moving away from traditional pricing models by using data-driven insights:

- Safe drivers pay less for auto insurance

- Healthier lifestyles result in lower premiums

- Homeowners with security systems can unlock discounts

These smart pricing structures reward responsible behavior and promote fairness in coverage.

4. Real-Time Adjustments as Life Changes

Major life events like marriage, having children, or switching jobs can affect your insurance requirements. Juntos Seguros allows:

- Instant plan upgrades or downgrades via the user dashboard

- Policy pauses or temporary changes when needed

- Seamless transitions during major life events

This real-time flexibility ensures your insurance plan always reflects your current situation.

5. Digital Tools for Easy Customization

The Juntos Seguros platform uses user-friendly technology to help clients design their ideal insurance package:

- Interactive plan builder

- AI-powered recommendations

- Transparent breakdowns of costs and benefits

These tools make it easy—even for first-time users—to understand and customize their policies.

6. Improved Customer Satisfaction and Retention

Customers are more likely to stay with an insurer that gives them control and value. Personalized plans by Juntos Seguros:

- Reduce claim disputes by offering clear, specific coverage

- Increase customer trust through transparency

- Boost satisfaction by meeting real-life needs

This fosters long-term loyalty and encourages positive word-of-mouth, both of which are crucial for sustainable growth.

7. Future-Proofing the Insurance Industry

The personalized insurance model embraced by Juntos Seguros represents the future of insurance. As consumer expectations rise, adaptability becomes key. Personalized plans:

- Integrate with wearables, smart homes, and telematics

- Evolve alongside technology and user behavior

- Cater to younger generations who value customization and digital convenience

Juntos Seguros is not only responding to industry changes—it’s setting the standard for what’s next.

Conclusion

Juntos Seguros understands that today’s customers demand more control, fairness, and flexibility from their insurance providers. Personalized insurance plans offer all that and more—delivering coverage that fits your life like a glove. By putting the customer at the center of every policy, Juntos Seguros is defining the future of insurance coverage—one custom plan at a time.